In an era of technology, it is essential to keep up on the latest software options available to professional estate planners. Since estate planning is a specialty in many professions, it is imperative to first understand what software platform best serves you current needs and what could enhance your practice moving forward.

There are two reasons to utilize software. First, it is a necessity to do business. Platforms like Microsoft Office and Customer Relationship Managers are a necessity to operate in business today. While software can be a necessity, they do not necessarily make you money, some are merely the cost of doing business. Second, there are software platforms that are used to make you money and grows your business. These platforms are an opportunity cost and one that could set your practice off the charts and differentiate you from other professionals. It is imperative to look at technology from these points of view.

In a technology world, it can be challenging to keep up on all the software available. We have done our best to provide a neutral overview of some of the popular and effective software platforms available today.

Document Prep Software

While documents are the core necessity of estate planning, there are pages of options on Google. We do not have the space to list all of them, but here are a few of the popular ones used by professionals.

Wealth Counsel – One of the largest organizations in estate planning for attorneys and a full provider of document prep software called Wealth Dox. Wealth Counsel offers several other options, such as; Business Dox and Gun Dox. As of recent, the platform is software based (as opposed to a download and desktop based).

Fore Trust Software – The software provides you with an automated process for the drafting and assembly of state specific estate planning documents. This software is desktop based and must be downloaded on a computer to be used. Pricing appears to be at a lower cost than that of most competitors.

Interactive Legal – A document prep service that provides a comprehensive system of easy-to-use document drafting system. Interactive Legal is a newer player on the market, but it appears they have recently enhanced their board of directors to gain recognition in the industry.

Lawgic – Their documents claim to be authored by nationally recognized estate planning experts, the programs patented Intelligent Legal Technology® uses a question and answer session to guide you through the drafting process.

Customer Relationship Software (CRM)

Salesforce – The largest customer relationship software (CRM) in the industry, but also one of the priciest. A clear leader in the CRM software industry with the resources to support it. If you are looking for the industry best, you would certainly need to take a look at Salesforce.

Clio – One of the popular CRM tools for attorneys. Clio offers all you need to run a law practice from intake to invoice, with powerful tools to manage cases, clients, documents, bills, calendars, time tracking, reporting, and accounting.

Practice Panther – A very thorough CRM that does a lot of business management. It starts by managing your contacts, trust and operating accounts. The platform syncs with QuickBooks, tracks time, calendars and emails (syncs with Gmail, Outlook, and more). Practice Panther provides a client portal, billing, intake forms & more.

Estate Planning Essentials (E2) CRM – This CRM is a Marketing Automation software specifically for the estate planning practice. The platform enables you to store, manage, track each interaction at every client touch point to trigger automation, analysis and utilize valuable data about your contacts.

Tax Calculations

Leimberg – While this software is very outdated, it is one of the most popular amongst those who work strictly on tax planning and estates. An inexpensive solution to the number crunching of estate planning.

Emoney Advisor – Known as a financial planning software, a module within the software helps show the distribution of assets and displays potential tax liabilities. If you are implementing detailed financial planning into your estate planning practice, Emoney Advisor is worth a look at.

Bloomberg BNA Software – A very comprehensive tax planning software, typically used by accountants. The platform has a module that provides charitable and gift planning. Very complex and thorough, the learning curve may be challenging, though.

Document Vaults

There are hundreds of document vault platforms, almost too many to name here. I only listed a few below. Most allow secure storing of documents, sharing and access. Some are client based and others are professional based. If you are providing this as a service, you may want to consider imbedding a link on your site for client access. Some of these platforms will not allow for that, so make sure you do your homework.

FidSafe – This is a free option created by Fidelity. If you work with Fidelity advisors it’s a must to share documents back and forth with those professionals.

Here are a few other popular document vaults that you may want to consider. DocuBank has been around for a while and offers a medical card to clients. Future Vault, Everplans and Estate Map are excellent ways to get clients involved and to manage and administer estates. These software platforms do not necessarily plan but serves as an aggregator of information. Unfortunately, most are also direct to consumer options, so while they serve a purpose they may not create a permanent link to the client.

The Intangibles

We call these the intangibles because these platforms are differentiators in a practice. Utilizing platforms such as these could be the difference between someone choosing your practice vs. another.

Estate Gen – A flowcharting software for attorneys. In a few easy steps, you'll be on your way to creating the most dynamic and intuitive flow charts for estate planning. While flowcharting could be done on Microsoft Power Point, Estate Gen is estate planning specific and allows for a better presentation.

Asset Map – A visual representation of a household’s current members and their current financial instruments including; assets, liabilities, income sources and insurance policies. This platform assists estate planners in comprehending the household big picture to promote suitable and proactive guidance.

Directive Communication Systems – The leader in digital asset servicing. With even more and more attention given to digital assets, Directive Communication Systems (DCS) goes beyond the aggregation of digital assets. It assists attorneys and personal representatives by organizing and contacting personal accounts to fulfill an individual’s final wishes.

Family Wealth Map – Designed to manage information for large complex estates. This platform provides a team confidence that its members have the complete set of information. Client Information Management or "CIM" is a new concept in the private-client practice. This platform strives to collect, organize and communicate information. Because they specialize in this area, they have the technology and expertise to make CIM efficient and cost-effective.

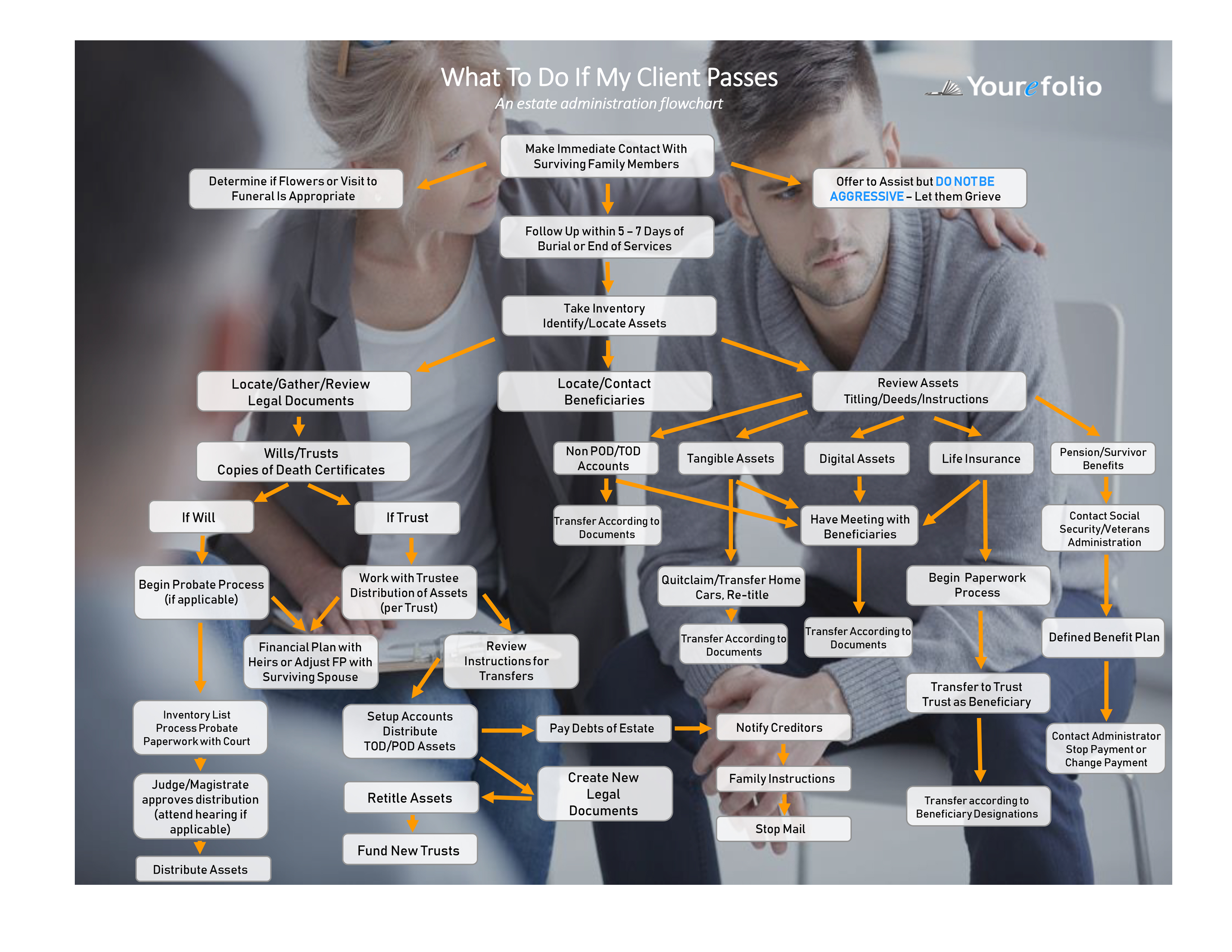

Yourefolio – A comprehensive platform that helps estate planners prospect potential clients, onboard new clients, analyze the estate, create a plan, easy reviews, communication, administration and settlement. Yourefolio provides flow charting, federal and state specific tax calculations and even legacy planning. Other than document prep, this platform does it all and can allow an attorney to expand their reach geographically.

Integrity Marketing Solutions – A website designer and marketing company with SEO optimization for estate planning attorneys. Integrity Marketing Solutions is the leader in comprehensive marketing and practice development for estate planning and elder law attorneys.

Around the Corner

These platforms are trying to take away from the profession by diminishing what estate planners do. These platforms are recent startups trying to go direct to consumer and cheapen the experience. Not quite like Legal Zoom or Rocket Lawyer, each tries a different angled approach to gathering business. Keep your eye on these startups.

Trustandwill.com – “You need a will. We make it easy”, their tagline. Make a complete and legal will in less than 10 minutes. Streamlined processes to give you more time to enjoy your life and more money for the causes you care about. The claim to “deal with the lawyers, so you don’t have to.” They charge $89 for an individual and $129 for a couple, which includes a living trust.

Willing.com – Claims to make planning for life-after-life easy and convenient for individuals and the people they love. “No waiting. No legal jargon. Just friendly technology that’s available 24/7 from anywhere” is the value proposition from willing.com. They claim to charge fair prices anyone can afford and their basic will is free. They offer more comprehensive plans at a fraction of the usual cost. Their maximum charge is $299.

Estateguru.com – This site claims that it is more than a stack of documents... it's a tool that guides you through every important step of your estate plan. They claim to create, share, maintain and settle estates. The software uses professionals to prepare the plans at an extremely inexpensive rate by recruiting them based on volume not value. Basic living trusts prepared by attorneys in every state are $600.

Tomorrow.me – Estate planning done on an app? Only time will tell. Tomorrow claims to help families of all types achieve financial peace of mind through better long-term financial decision making by providing essential estate planning for free in an easy to use mobile app. Here’s what included, free, with the Tomorrow app, a Last Will & Testament, Revocable Living Trust, Guardianship Protection for Children, Guardianship for Pets, Net Worth Calculator, Life Insurance Calculator, Term Life Insurance Comparison Shopping & Purchase. They have raised over $2 million in funding and make money by attempting to sell insurance.

We hope this short review of estate planning technology helps you when looking forward. While we admit that some of these platforms are great, we DO NOT endorse any platform. Software solutions are not right for every person and every practice. Please evaluate the solutions for your own situation. If you are looking for guidance in establishing and implementing effective technology in your practice, feel free to reach out. We would love to help. You can contact us at info@yourefolio.com.

About Yourefolio

Yourefolio is an advisor driven software created by financial advisors, estate planning attorneys, insurance professionals and Certified Financial Planners®. The modern day estate and legacy planning software is designed specifically for professional estate planners for the benefit of everyone involved in estate and legacy planning. Yourefolio’s unique platform bridges the gap of understanding between all parties involved. Yourefolio brings the full circle of estate planning to an innovative experience. There is simply no other estate and legacy planning software like it. Yourefolio will forever change the way estate planning is done, it will also change how clients and beneficiaries experience it. Yourefolio is revolutionizing the way estate planning is done in the 21st century

For more information email us at info@yourefolio.com or visit www.yourefolio.com