As we live longer, it’s imperative to plan smarter.

Steven Abernathy 1 | Dec 29, 2017

A moment can change everything.

Whether it’s an illness impairing judgment, an accident or unforeseen tragedy, thinking about life’s worst curveballs (never mind preparing for them) isn’t always on an investor’s radar. But not planning for them can be far worse—especially for those who’ve spent a lifetime accumulating and building their wealth. The Alzheimer’s Association reported that one in three seniors dies with Alzheimer’s disease or another form of dementia. According to a 2015 Rocket Lawyer estate planning survey by Harris Poll, 64 percent of Americans don’t have a will.

As we live longer, it’s imperative to plan smarter.

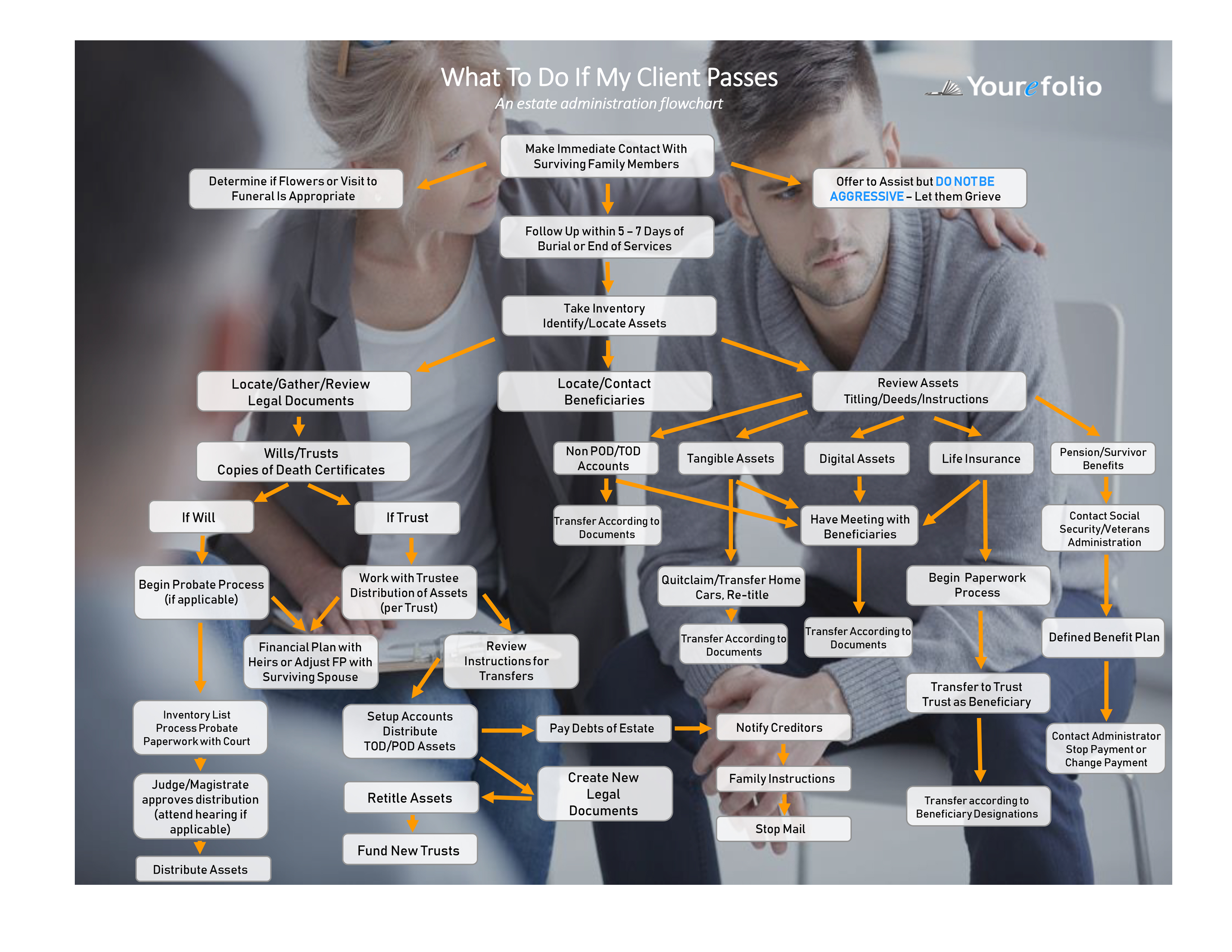

For affluent families planning to pass their wealth to the next generation with minimal taxes and slippage, trust and estate planning are crucial components—as is the education of heirs so that when the time comes, they’ll not only be capable of making important financial decisions but have the experience to do so.

Unfortunately, those with a solid plan are in the minority. For those who don’t have one that’s clearly defined, burdens can abound. Fights about who makes financial decisions can ensue. Vulnerable family members may lose financial support and unknowns often mean long, stressful court decisions—even if there are no contentious elements. A solid plan not only names representatives and decision makers who’ll step in if one becomes impaired, but, acts as a blueprint for how to move forward on both health- and wealth-related fronts.

The bureaucratic workings of the current healthcare system, coupled with the intricacies of modern medicine, are likely to mean a patient has a team of doctors—a primary care physician and specialists, as well as prescription medications, histories, tests and other data related to their healthcare. Accessing needed information quickly, particularly in cases where a patient cannot make decisions for themselves, is crucial. Health and wealth are linked. When families evaluate their planning process around wealth, it is wise to include healthcare directives as needed also.

Step No. 1: Get organized

The first step is to get your paperwork in order. If you use an electronic vault, a repository for vital financial, legal, medical and personal information, confirm who has access and to what. When your loved ones can easily access crucial details, it makes the planning process go more smoothly. In addition to contact information for doctors and other key people, include immediate family and those who are involved in decision making, such as: agents, lawyers, wealth managers, accountants and trustees. If who has power of attorney isn’t clear, make sure to designate this as appropriate.

Step No. 2: Be specific

Every area of a decision-maker’s life (legal, financial, medical) has information that is usually scattered in multiple formats and places. Consolidating what needs to be reviewed into one place provides representatives with the information required to act on another’s behalf. This includes recent statements from all accounts, records of beneficiary designations with contact information, the latest tax return and copies of recurring bills as well as insurance information. Detailed medical information (directives, health care powers of attorney, insurance card numbers and information, health conditions, medications and health records) should also be included. Legal documents (if copies) should note where originals are housed, plus who has power of attorney, beneficiary designations and trustees (if applicable).

Step No. 3: What are the best ways pass responsibilities to others?

When assessing a plan, there are many ways to involve people—there’s no one path. This is an area where planning ahead can be highly beneficial. If the decision-maker’s capacity is undiminished, looking at areas that might be delegated (i.e., a bookkeeper can pay regular bills) could begin the process. Sometimes individuals will ask for the counsel of a friend or a family member on an informal basis. However, more formal arrangements for transferring control are recommended—particularly when legal accountability is required or preferred, such as with a trust. There are assets where creating equal, shared access is simple—such as a joint bank account. When both owners control the asset, if one (usually a spouse) becomes incapacitated, the other retains control without incident.

Step No. 4: Determine who holds the power

If an agent holds legal power of attorney, the role might be rather broad. A common way to provide a level of accountability is to name two people who must act jointly (i.e., both must sign checks). Often a successor agent is recommended if an individual cannot continue with the responsibility placed upon him or her. In addition, there may be a level of regular accounting to an outside facilitator, such as a Family Office or an attorney. Naming a professional, neutral third party who is not a family member can save time, reduce emotional toll and act in the best interest of the family.

When one holds power of attorney for asset management, the “principal” delegates certain authorities to a representative. The principal must have the mental capacity to enter the agreement. If mental capacity is in question, the individual’s competency must be documented when the papers are signed. Durable power of attorney grants a broad range of access that continue until revoked, terminated or upon the principal’s death. It’s important to check with any financial institutions to determine if they have any challenges honoring power of attorney.

Step No. 5: Know your trusts

Attorneys can structure trusts in a myriad of ways to split control between a principal and others. However, if the principal can no longer be the decision maker, one way to transfer control relatively easily is to have durable power of attorney and a revocable living trust. A simple structure can be easy to set up and administer. A trust is flexible in terms of distribution. Beneficiaries will receive distributions of property according to the grantor’s instructions. In general, when the trust is set up, assets are re-titled to be held in trust. If the grantor is physically debilitated or suffers mental decline or incapacity, there may be an issue with funding the trust. However, if the agent with power of attorney to fund the trust can also withdraw the assets, this may be an excellent workaround. The agent may also be given power to change the trust’s terms or revoke it altogether. Here again, an outside facilitator from a family office can offer counsel.

Working with a corporate trustee adds expense, but a professional will minimize problems that could arise when individuals are chosen who don’t have the professional expertise to fill the role or may not have the individual’s best interests at heart.

As the likelihood of impaired brain function, physical ailments and illness increases with longer life spans, now more than ever a contingency plan is vital. A complete financial plan contains the blueprint for how to transfer decision-making to a representative should it become necessary.

While no one wants to prepare for the worst, decades of meticulous planning and preparation can be undone very quickly when left unchecked. Professional wealth managers, such as a family office, are legally bound to act in the fiduciary interests of their clients. Considering guidance from an objective professional can not only implement a savvy estate plan, but, put in place the preparations necessary for the next generation’s leadership no matter what the circumstances.

Steven Abernathy counsels affluent families on multi-generational wealth management strategies and corporate retirement plans.